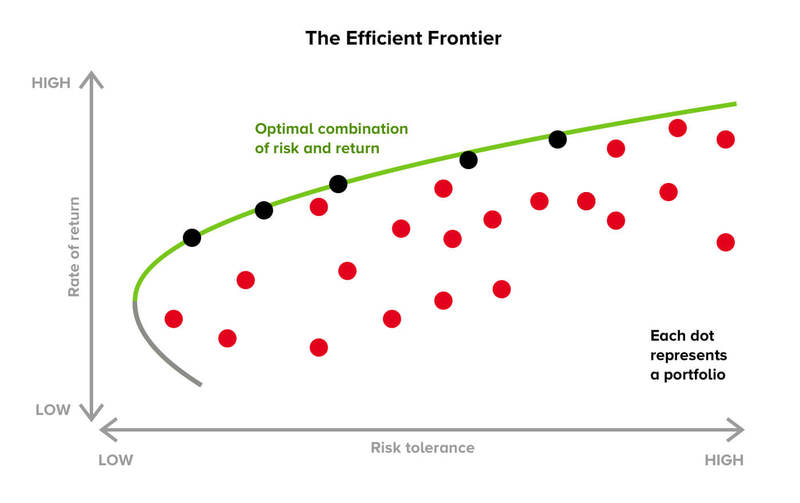

Efficient Frontier

A key concept in modern portfolio theory. The efficient frontier represents the set of optimal portfolios that offer the highest expected return for a defined level of risk or the lowest risk for a given level of expected return. Portfolios that lie on the efficient frontier are considered optimal because they maximize returns while minimizing risk.

Mathematically, the efficient frontier can be derived by solving the following optimization problem:

Where:

- is the vector of portfolio weights.

- is the covariance matrix of asset returns.

- is a vector of ones.

- is the vector of expected asset returns.

- is the target expected return of the portfolio.

- represents the portfolio variance (risk).

- The first constraint ensures that the sum of the weights equals 1 (full investment).