Bond

A bond is a type of Financial Security that represents a loan made by an investor (the bondholder) and a borrower (typically a corporation or government).

The borrower agrees to pay periodic coupon payments (interest) and return the principal (face value) at the specified maturity date.

Bonds are valued by discounting all expected future cash flows, both coupons and principal repayment, to their Present Value using the Market Yield to Maturity as the discount rate.

In essence, the bond’s price equals the sum of the Present Value of all future payments (or its Net Present Value).

Features

The below features fully define a bond:

- Face value (aka par value): The amount the bond issuer promises to repay at maturity. It is fixed and does not change.

- Principal amount: total value of all bonds solve by the company (e.g. 1,000 each)

- Currency: CAD, USD, etc.

- Maturity: time in years until bond is repaid

- Coupon: amount of interest paid to the bond holder

- Fixed coupon: rate of interest does not change

- Floating coupon: interest tied to some benchmark rate (prime, LIBOR(SOFR))

- Frequency: number of coupon payments per year

- Canadian and US bonds typically pay interest semi-annually (s.a)

- European and Japanese bonds typically pay annually

- Quoting convention: This is the convention used when comparing yields across different instruments. Most common convention is Annual Percentage Rate (APR) with semi-annual compounding.

- Type of Security (or collateral):

- Secured: backed by an asset (e.g. mortgage)

- Unsecured: no specific asset; general claim. Also called debenture.

- Seniority: specify priority of claim in bankruptcy; who gets paid first and in which order. Senior bonds get paid before subordinated bonds.

- Covenants:

- Restrictions on corporate activities (mergers, payouts, etc.) laid out in the bond indenture / contract.

- Typically include ratios and other financial metrics standards (e.g. interest coverage must exceed…)

- Repayment provision: callable, convertible (i.e. exchangable into equity)

- Yield to Maturity (YTM): The Internal Rate of Return of a bond when held to maturity.

Valuation of Coupon Bond

The value of any Financial Asset is the sum of the Net Present Value of all future cash flows generated over its life.

In summary, you need to know 3 things to value an asset:

- What are the cash flows?

- When are the cash flows?

- What discount rate to find PV of cash flows?

For a bond, the cash flows are the periodic coupon payments and the principal repayment at maturity. The discount rate is the Market Yield to Maturity as that’s the current market rate for similar bonds.

Example

What is the price of a 2-year bond with an annual coupon rate of 7% (coupons paid semi-annually) and a face value of $1,000 if the market yield to maturity is 6% APR with semiannual compounding?

Three pieces of information:

- Cash flows:

- Coupon payment every 6 months = (7% / 2) * 35

- Principal repayment at maturity = $1,000

- Timing of cash flows:

- Coupons at t = 0.5, 1.0, 1.5, 2.0 years

- Principal at t = 2.0 years

- Discount rate:

- Market YTM = 6% APR s.a. = 3% per 6 months

Using our Present Value formula:

Valuation of Zero Coupon Bond

A zero-coupon bond does not pay periodic interest. Instead, it is issued at a discount to its face value and pays the full face value at maturity.

Where:

- Face Value: amount paid at maturity

- YTM: yield to maturity

- n: number of periods until maturity

”Pricing” New Bonds

While the above valuations are the “fair value of the contracts”, they fail to account for the risk premium that investors demand when buying new bonds. That is, if I’m lending money to a company at risk of going into default, I want to be compensated for that risk.

This is done by adjusting the YTM that is used in the above calculations.

Types of Risks:

- Credit Risk: risk of default

- Liquidity Risk: cannot sell an asset when you need/want to

- Inflation risk: change in price level

- Market risk: overall market fluctuations

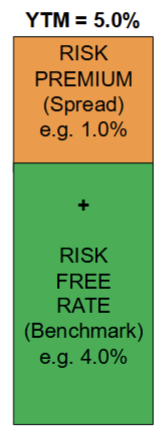

To establish the required rate of return that is used when discounting the cashflows and valuing a bond, we start with a “benchmark” risk-free rate and add a risk premium based on the credit risk of the issuer and risk of the specific bond (e.g. subordinated).

Credit Rating Agencies

Credit Rating Agencies (CRAs) provide an assessment about the ability and willingness of issuers (e.g., companies, governments) to meet their financial obligations.

- They assign a credit rating that captures the risk inherent in the debt of a company

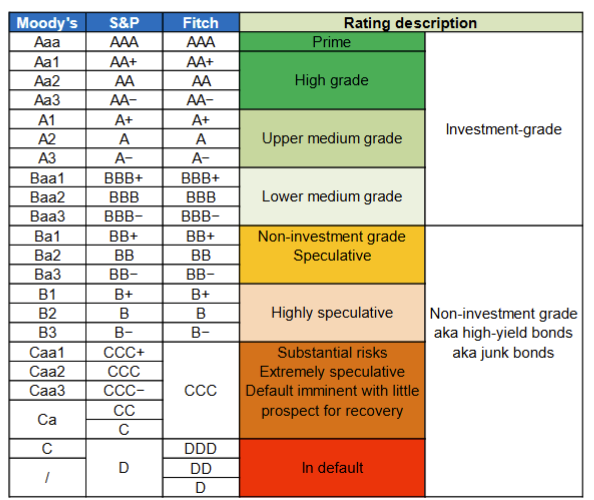

- The scale used by CRAs give a top rating of AAA which declines to D (default)

- There are 3 major agencies: Standard & Poor’s (S&P), Moody’s, and Mitch

- Canada: Major debt rating agency is the Dominion Bond Rating Service (DBRS).

Credit Rating Scale

Note: BBBis the cut off, that is, when a company drops below BBB-, it is no longer considered investment-grade and loses a lot of value.

Credit Ratings Methodology

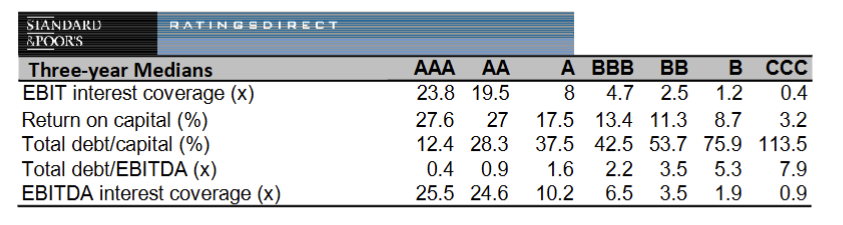

CRAs use financial ratios as one important input to the credit rating process.

However, there are many other quantitative/qualitative considerations behind a rating. CRAs also have access to non-public information.

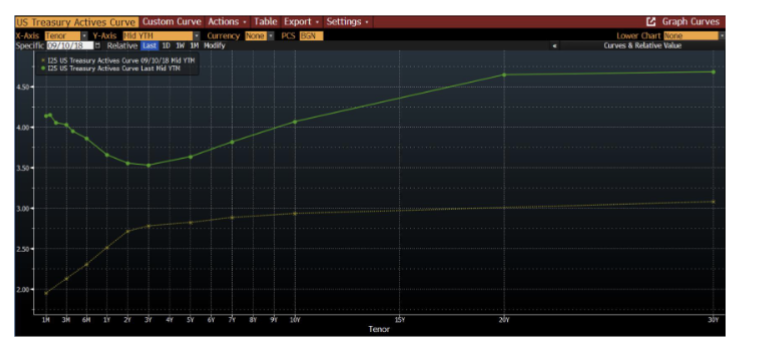

Keep in mind that the YTM is also a function of the maturity of the bond. Longer maturities typically command higher yields due to increased risk over time. Below is a curve representing the US yield curve. Green is from Sept 12, 2025 and gold is from Sept 10, 2018

Conclusion

- When “pricing” a new bond, we need to estimate the return bond investors will require, given the inherent riskiness of the bond

- Credit rating provide a quantifiable measure of that credit risk

- Many companies already have a credit rating

- For those that don’t, we can look at financial ratios and approximate their rating

- Once we have (or estimate) a company’s credit rating we can map that rating to the corresponding required return by looking at the bond spread of similar companies