HBA1 Finance Course

“Finance” course, taught in the first term of HBA1.

Exams - Final

- Concepts Covered:

- Focus is on second half of the course

- Previous concepts remain important (Time Value of Money, Capital Structure, Financial Ratios, Growing Perpetuities)

Module 4: The Cost of Capital

Module 5: Valuing Long-Term Investments and Businesses

Acquisition

- The acquirer refinances the target’s debt, and therefore the cost of debt changes to the buyer’s cost of debt.

Exams - Midterm

Module 1: Time Value of Money

Lecture: Time Value of Money

Primer

Note: below information is all duplicates of their respective notes. There exists atomic notes for all concepts including mathematical formulas and documentation on excel functions.

| Concept | Mathematical Formula (inline) | Excel Function |

|---|---|---|

| Future Value | • PV = present value • r = required rate of return • n = number of periods | =FV(rate, nper, pmt, [pv], [type]) • rate = required rate of return • nper = number of periods • pmt = recurring payment amount • pv = present value |

| Present Value | • FV = future value • r = required rate of return • n = number of periods | =PV(rate, nper, pmt, [pv], [type]) • rate = required rate of return • nper = number of periods • pmt = recurring payment amount • fv = future value |

| Net Present Value | • = cash flow in a given period • r = required rate of return | =NPV(rate, value1, value2, …) • rate = required rate of return • values = undiscounted future cash flows (starting in period 1) |

| Internal Rate of Return | No closed-form expression (cannot be calculated analytically). | =IRR(values) • values = undiscounted cash flows beginning at time zero |

Module 2: Financial Markets and Alternatives to Raising Capital

There is a lot of content here, but the main concepts are:

Additionally, we have some extra information here regarding terms:

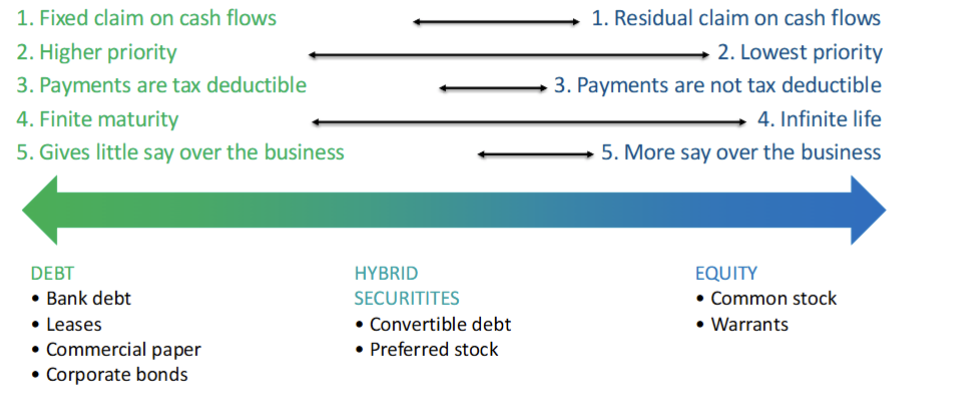

Bonds vs. Stocks

Bonds:

- Fixed obligations

- Payment structure is generally known when issued.

- Indirect control only through debt contract terms

- Relatively high priority in bankruptcy

Stocks

- Residual claim on the firm

- No guarantee of dividends or return of capital

- Lowest priority in bankruptcy

- Voting control

Equity

We also note a important strategy Dividend Discount Model