Modigliani and Miller Capital Structure “irrelevance” Theory

Modigliani and Miller (M&M) showed that if certain assumptions hold, the choice of Capital Structure “doesn’t matter”. This is known as the Capital Structure Irrelevance Principle.

That is, choice between debt and equity has no impact on market value IF:

- No taxes

- No cost of financial distress / bankruptcy

- Financing has no impact on a firm’s investment decisions (firm will invest in the same projects no matter how it is financed)

- Capital markets are “perfect”

- All investors have the same information

- Capital always available at “fair” prices

In reality, these assumptions do not hold, so capital structure does matter. That is:

- Firms’ pay taxes

- Financial distress and bankruptcy have costs

- Financing can impact investment decisions (e.g., debt covenants may restrict certain investments)

- Capital markets are not perfect

- Information asymmetry exists

- Capital may not always be available or may be costly

Example

Consider two firms, U and L

Perfect World

FIRM U

- CS: $100 equity = $100 assets

- no debt

- The firm generates EBIT of $10

- With no debt or taxes, EBIT=EBT=NT

- The firm pays out all earnings as dividends so

- Total amount paid out = $10

FIRM L

- CS: $50 equity + $50 debt = $100 assets

- Debt has a coupon rate of 5%

- EBIT = $10 (CS does not affect EBIT)

- Interest expense = $50 * 5% = $2.5

- EBT = NI = $10 - $2.5 = $7.5

- Total amount paid out =$\7.5 to equity holders + $2.5 to debt holders = $10

CONCLUSION

If markets are efficient, firms paying out the same cash flows in the form of dividends and interest payments must have the same valuation!

But note, in an unlevered firm

Whereas in the levered firm

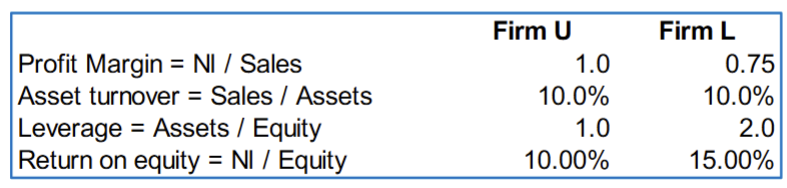

The important point here is that, Leverage affects ROE

ROE Decomposition

Real World

Now assume the corporate tax rate = 35%

Remember:

- Interest expense is paid out of pre-tax income

- Dividends are paid out of after-tax income.

Therefore, in a world with taxes, the value of the firm, as measured simply by cash flows / payout, increases with debt! This is because of tax-shields.

FIRM U

- CS: 100 assets

- no debt

- EBIT = $10

- Taxes = 3.5

- NI = 3.5 = $6.5

- Total amount paid out = $6.5

FIRM L

- CS: $50 equity + $50 debt = $100 assets

- Debt has a coupon rate of 5%

- EBIT = $10

- Interest expense = 2.5

- EBT = 2.5 = $7.5

- Taxes = 2.625

- NI = 2.625 = $4.875

- Total amount paid out = $4.875 to equity holders + $2.5 to debt holders = $7.375

CONCLUSION

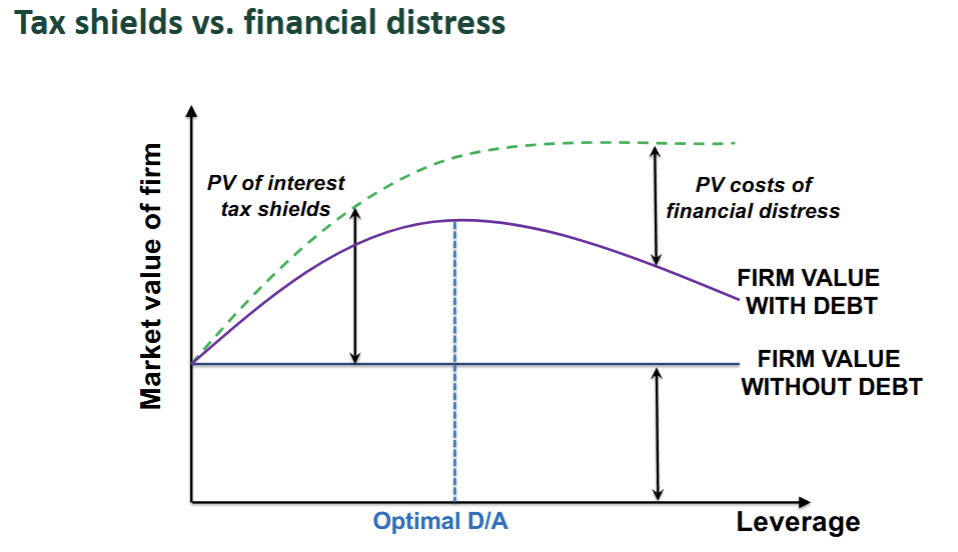

In a world with taxes, the value of the firm increases with debt because of tax-shields on interest payments.

Impact

So why don’t all firms just use 100% debt financing?

Because the risk of bankruptcy or financial distress is very costly

- Direct costs: legal & administrative costs

- Indirect costs: management time, negative NPV activities, foregone investments, loss of customers, problems with suppliers, retention of employees

Shareholders understand this and expect a higher return for a riskier firm.